Unification is the Automobile Industry's Path to Mobility

The airline industry is a single-use service model for consumers. After all, our interests as consumers are about getting to our destination. At a local level, why don’t automobiles work the same way? Why is the customer experience so disjointed?

I co-wrote this article with Reilly Brennan, Partner at Trucks Venture Capital. He writes an awesome weekly newsletter on the Future of Transportation, subscribe here.

It’s not difficult for us to visit each other in Detroit and San Francisco. We don’t own a plane. We don’t maintain the plane. We don’t worry if there is gas in the plane. We don’t consider the most optimal flight route. We don’t even have to park the plane. All we do is buy the ticket and take the ride.

The airline industry is a single-use service model for consumers. After all, our interests as consumers are about getting to our destination. At a local level, why don’t automobiles work the same way? Why is the customer experience so disjointed?

It is our belief that business models which unify consumer experiences will dominate the future of mobility. A service model approach will win the future of the industry.

The Car Ownership Burden

For decades we believed that car ownership was the ultimate freedom. Instead of making automotive ownership simpler over the years, the consumer experience has become more fragmented and burdensome.

Consider that purchasing a car represents a small part of car ownership, in both time and money. On a typical passenger car like a Toyota Camry or Ford F-150, the vehicle itself is less than half of the cost of ownership. In reality, the cost to own a vehicle is more closely linked to that which it consumes:

- Fuel

- Maintenance and repair

- Insurance

- Parking

- Registration and financing fees

All of these non-vehicle items together represent some 60% of what you’ll spend. We call these the ‘five horsemen’ of hidden auto fees: buying a car today gives you the privilege to spend a lot of money on a number of disaggregated services. You have to do this on your own, across multiple vendors who do not communicate with one another.

The day you take possession of a new car, you have unwittingly become your car’s general contractor, forced to constantly re-organize and schedule things such that your vehicle can be at the minimum functional and, hopefully, legal. These non-trivial set of services represent an aggregate of $400B annually within the US economy, but have all the organization of a dog’s breakfast.

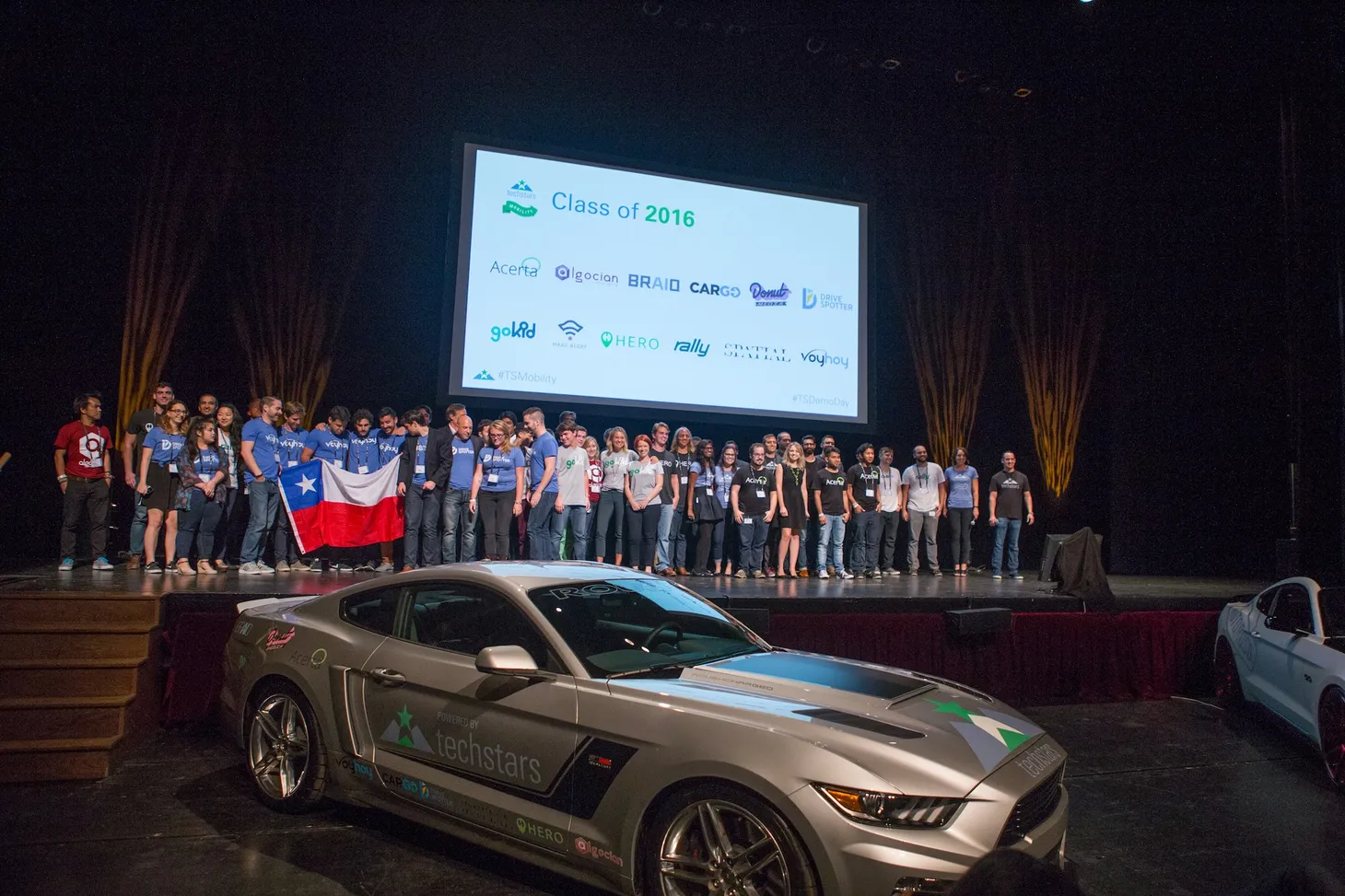

Startups at the forefront of innovation have noticed this problem too. Techstars Mobility saw hundreds of applications from 52 countries across 6 continents for its 2016 program. When we analyzed these global mobility applications for trends, we saw that the second biggest trend was startups attacking the full lifecycle of customer experience for owning and maintaining a vehicle.

The 4 Components of Mobility’s Coming Unification

This unbundling of a vehicle from its necessary services creates a lot of undue work, but it doesn’t have to be this way (in fact, historically, it wasn’t always this way). We posit that fundamental changes in mobility will allow these services to unify into one, and that the natural tendency of successful mobility companies will be unification of core services.

The following are the traits of highly unified mobility companies:

- On-demand fleets are a pure service model, with little ownership downsides

To illustrate how on-demand fleets are already unified, you don’t have to think about the license plate fees, insurance, or even gas in your Uber ride. Your use assumes a level of service that the company provides. These are the classic characteristics of a service model. - Electrification simplifies maintenance, repair and reduces “fuel” costs

Owners of electric vehicles do over 80% of their charging at home, shrinking both the time and money commitment of ‘gassing up.’ And given the far fewer number of parts within an EV compared to a traditional car, repair and maintenance over the initial five-year period of ownership is significantly lowered. By shrinking or eliminating these “horsemen,” EVs are a natural forcing function for unification. - Unified customer profiles are worth dramatically more than 1 car sale

When the mythical “Apple vehicle” arrives, its most significant contribution might be its unified customer profile. This profile not only has basic data like name and email, but vital payment data. Payment simplicity has remarkable platform unification effects, and a vehicle and its services tied to one Apple ID will be easy to manage. Today, hardly any of the automakers have your credit card number or your email address. Getting all of these services to one payment method is both a useful goal and also a consumer benefit. - Bundled Service & Maintenance Costs

Ridesharing companies don’t ask a lot from their users – just hit a button, take a ride and pay with your credit card. Traditional automakers must consider their consumer is now familiar with easy mobility services and has had a taste of how simple they are to operate. In this sense the automakers have to design their ownership experiences to be as easy and push-button as a service. How should they do this? Enable all of the “five horsemen” to be controlled by the user through a single method. Don’t force the owner to do this work on their own.

The Future Is Unified

In our view, car companies will decay if they delay unification. Those still shoving the “five horsemen” responsibilities to their customers will find they are left behind for simpler options.

Announcements of autonomous fleets from Ford, BMW and others over the last quarter point to large manufacturers attempting to evolve into a service model. But it is not just the automotive OEMs that are moving towards unification: It is new entrants, including companies like Apple, which this year invested $1 billion in Chinese TNC Didi Chuxing. This investment bought them 3 key things that relate to our unification principles:

- Access to the world’s largest unified transportation network (Didi has many more ride types and vehicle form factors than Uber, for example)

- The largest number of installed end users with a unified payment system

- The world’s largest market

Today’s automotive and mobility companies that design around unification – even if they are selling a traditional ownership model – will dramatically simplify the lives of their consumers. And they will be in a stronger position to transition to a full service model as their customers give up the burden of today’s uncoordinated vehicles.

As a radar view of where this is headed, we can point to the recent Techstars Mobility demo day last month in downtown Detroit. Over 2500 individuals watched in person or remotely via the livestream of 12 startups impacting the future of mobility. Autonomous, connected, and shared mobility startups all demonstrated how they are taking these unification principles and shaping the future of transportation.

–

Notes:

$400B comprised of:

- $280B: Fuel industry size US autos

- $80B: Repair industry size US autos

- $36B: Insurance industry size US autos

GM offered its own financing through GMAC, insurance through Motors Insurance Corporation, and fuel in part through its shared ownership of Ethyl Corporation with Esso and duPont.

Ted Serbinski Newsletter

Join the newsletter to receive the latest updates in your inbox.